The Process

Buy, Refurbish, Rent

Buy, Refurbish, Rent (BRR) is a property investment strategy that has gained popularity among investors looking to build wealth through property. It involves a series of steps aimed at acquiring distressed or undervalued properties, renovating them to increase their value, refinancing to recover invested capital, and then renting out the property for ongoing cash flow.

Here's a breakdown of each step:

Buy: The first step is to identify and purchase a property that meets specific criteria for investment. Typically, BRR investors look for distressed properties, such as foreclosures, short sales, or properties in need of significant repair, that are priced below market value. This initial purchase is financed through various means, such as cash, conventional loans, or hard money loans.

Refurbish: After acquiring the property, the investor undertakes renovations and improvements to increase its value. This could involve anything from minor cosmetic upgrades to major structural repairs, depending on the condition of the property and the investor's budget. The goal is to enhance the property's appeal and functionality, ultimately allowing it to command higher rents or resale value.

Rent: With the property renovated and refinanced, the final step is to rent it out to tenants. The rental income generated from tenants provides ongoing cash flow and helps cover expenses such as mortgage payments, property taxes, insurance, maintenance, and property management fees. The goal is to achieve positive cash flow, where the rental income exceeds the expenses associated with the property, resulting in a steady stream of passive income for the investor.

Refinance: Seasoned investors may go on to refinance the property with a new loan based on its higher appraised value. The proceeds from the refinancing are used to repay the initial acquisition and renovation costs, effectively recycling the investor's capital for future investments. Ideally, the new loan should provide favourable terms, such as a lower interest rate or longer repayment period, to improve the property's cash flow and overall return on investment.

By repeating this process with multiple properties over time, investors can build a portfolio of income-producing real estate assets while maximizing their return on investment through value-add strategies and leverage.

Starting at the very heart of the operation Colinton Property Broker are able to identify suitable investment properties.

In conjunction with our trusted Partners we can assist at every stage of the process.

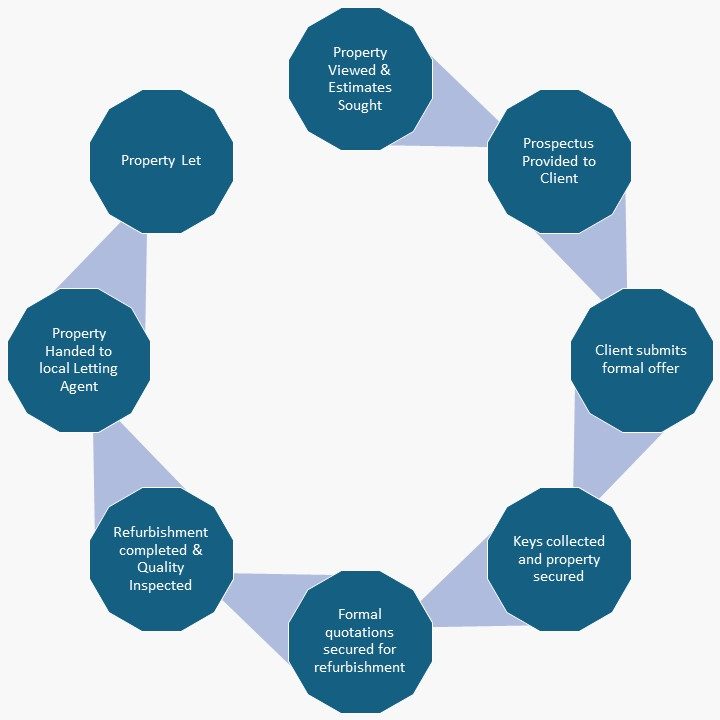

Our Step by Step Guide

Contact us

Proudly Registered with;

ZB690644

XWML00000197938

PRS045841

The value of your investment can fluctuate in both directions. Historical trends and predictions are not always an accurate predictor of future results. We aim to provide useful information to guide you in making an informed decision. Still, seeking advice from a qualified financial or investment advisor for your unique circumstances is crucial. We do not offer tax or financial guidance and solely provide general information to aid in your investment decision-making process. We recommend investors seek independent advice and undertake their own due diligence prior to investing in any of the projects we introduce to them. Investment opportunities are not suitable for the general public or inexperienced investors. This is not retail crowdfunding and is not suitable for retail investors. Past performance does not guarantee future results.

©Copyright. All rights reserved. Colinton Property Brokerage Ltd - SC804636

We need your consent to load the translations

We use a third-party service to translate the website content that may collect data about your activity. Please review the details in the privacy policy and accept the service to view the translations.